Nvidia, the world’s leading artificial intelligence company, reported stellar earnings for the fourth quarter of 2023, beating analysts’ expectations and raising its revenue guidance. The earnings report boosted the share price of Nvidia, as well as the exchange-traded funds (ETFs) that have a large exposure to the company and its peers in the tech sector. Here are the details of the Nvidia earnings report, and its impact on the AI and Mag 7 ETFs.

Nvidia beats estimates and guides higher

Nvidia, the $1.8 trillion multinational technology company headquartered in Santa Clara, Calif., announced its fourth-quarter results for the fiscal year 2023-24 on Feb. 21, 2024. The company reported a revenue of $9.8 billion, a 55% increase year-over-year, and a net income of $3.1 billion, a 71% increase year-over-year. The company also reported an earnings per share (EPS) of $1.24, beating the consensus estimate of $1.15.

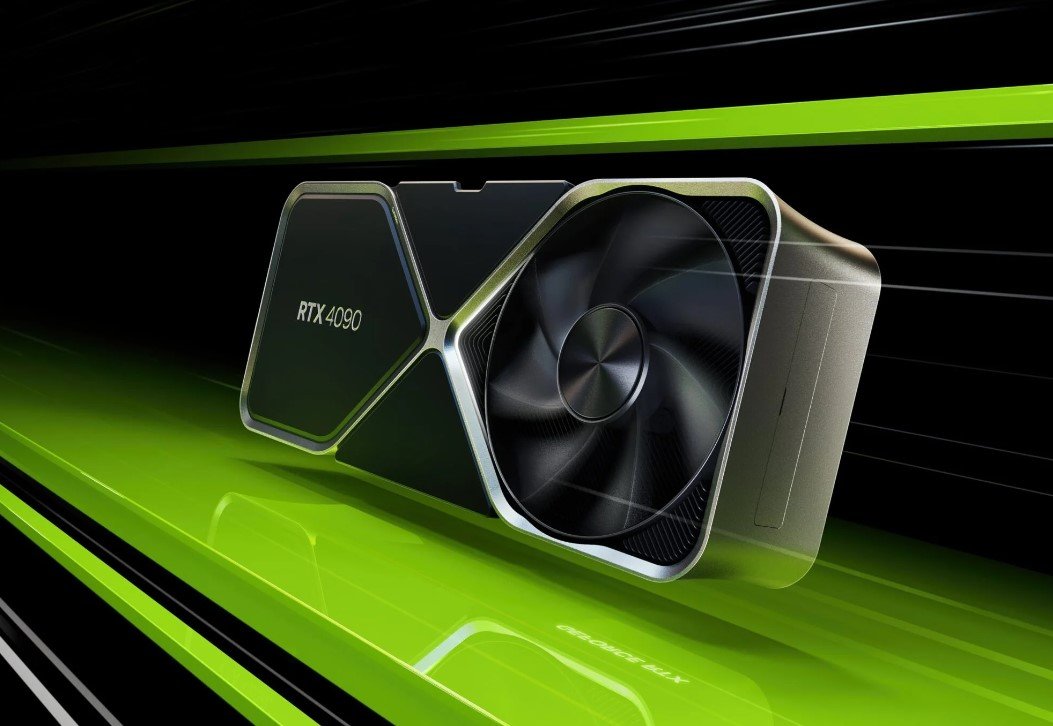

The company attributed its strong performance to the robust demand for its products and services across various segments, such as gaming, data center, automotive, and professional visualization. The company also benefited from the launch of its new products, such as the GeForce RTX 30 series graphics cards, the Ampere architecture, and the Omniverse platform.

The company also raised its revenue guidance for the first quarter of the fiscal year 2024-25, expecting a revenue of $10.6 billion, plus or minus 2%, which is higher than the analysts’ estimate of $9.5 billion. The company also announced a quarterly cash dividend of $0.16 per share, payable on March 31, 2024.

Nvidia shares jump and lift AI and Mag 7 ETFs

The earnings report was well received by the investors, who pushed the share price of Nvidia up by more than 5% in the after-hours trading. The share price of Nvidia has gained over 200% in the past year, making it one of the best-performing stocks in the market.

The share price of Nvidia also lifted the ETFs that have a high exposure to the company and its peers in the tech sector, especially the AI and Mag 7 ETFs. The AI ETFs are the funds that invest in the companies that are involved in the development and application of artificial intelligence, such as Nvidia, while the Mag 7 ETFs are the funds that invest in the seven largest and most influential tech companies in the world, namely Nvidia, Apple, Microsoft, Amazon, Google, Facebook, and Tesla.

Some of the ETFs that benefited from the Nvidia earnings report are:

- The VanEck Semiconductor ETF (SMH), which has a 25% allocation weight to Nvidia, and a 10% weight to the other Mag 7 stocks. The ETF has gained 67% in the past year, and is up 1.5% in the after-hours trading.

- The Global X Robotics and Artificial Intelligence ETF (BOTZ), which has a 20% allocation weight to Nvidia, and a 7% weight to the other Mag 7 stocks. The ETF has gained 27% in the past year, and is up 1.2% in the after-hours trading.

- The Invesco QQQ Trust (QQQ), which has a 9% allocation weight to Nvidia, and a 40% weight to the other Mag 7 stocks. The ETF has gained 44% in the past year, and is up 0.8% in the after-hours trading.

The outlook for Nvidia and the AI and Mag 7 ETFs

The outlook for Nvidia and the AI and Mag 7 ETFs is positive, as the company and the sector are expected to continue to benefit from the growing demand for digital transformation and cloud services, as well as the innovation and leadership in the field of artificial intelligence. The company and the sector are also expected to face some challenges, such as the regulatory and pricing environment, the competition from the rivals, and the high expectations from the investors. The company and the sector will have to maintain their growth momentum and exceed the investor expectations to sustain their bull run.